What It Means for Your FinOps Strategy (And What to Do Now)

Flexera Acquires ProsperOps

Two days ago, Flexera announced it acquired ProsperOps.

If you’re one of the companies with AWS spend managed by ProsperOps, you probably have questions. What happens to the product? Will pricing change? Will you be forced into Flexera’s broader platform?

Here’s what we know, what it means, and what your options are.

What Actually Happened

Flexera, the enterprise IT asset management giant, acquired two companies on January 6, 2026:

- ProsperOps: Autonomous cloud discount optimization for AWS, Azure, and GCP. $6B in annual cloud spend under management.

- Chaos Genius: AI-driven cost optimization for Snowflake and Databricks.

This follows Flexera’s previous acquisition of Spot by NetApp’s FinOps capabilities and their integration of Snow Software.

The pattern is clear: Flexera is building a sprawling FinOps platform through acquisition.

Why This Matters If You Use ProsperOps

ProsperOps built its reputation on one thing: autonomous discount optimization that actually worked. No bloated platform. No enterprise sales cycle. Just connect your AWS account and start saving.

That focus is what made it good.

Here’s the concern: acquisitions change products. Not always immediately, but inevitably.

What typically happens post-acquisition:

- Roadmap shifts. Product priorities align with the parent company’s strategy, not your needs.

- Bundling pressure. “You’re already using ProsperOps, why not add Flexera One for ITAM?”

- Pricing adjustments. Enterprise parent companies have enterprise margins to maintain.

- Support changes. The team that built it isn’t always the team that maintains it.

- Integration overhead. New systems, new logins, new account managers.

ProsperOps will “continue operating under its own brand,” according to the press release. That’s standard acquisition language. It means nothing about 12 or 24 months from now.

Want an accurate up to the minute savings Calculation?

The free zero obligation CloudFix assessment will unlock an accurate picture of what discount optimization will be able to do for you

Run your free AssessmentThe Bigger Picture: FinOps Consolidation

This isn’t just about ProsperOps. The FinOps market is consolidating fast.

Flexera has now acquired multiple point solutions. Other large players are doing the same. The result: fewer independent, focused tools. More sprawling platforms that try to do everything.

If you chose ProsperOps because you wanted a focused tool from an independent vendor, that vendor is no longer independent.

Your Options

Option 1: Wait and See

Stay with ProsperOps. Hope the product stays good. Monitor for pricing changes, feature degradation, or bundling pressure.

Risk: By the time problems emerge, you’ve lost time. Switching costs only increase.

Option 2: Move to Another Big Platform

Switch to a different enterprise FinOps suite like CloudHealth, Spot, Apptio.

Risk: Same problem. These are all either acquired or acquiring. You’re trading one enterprise platform for another.

Option 3: Find an Independent Alternative

This is where I’ll be direct: we built RightSpend for exactly this scenario.

RightSpend does what ProsperOps does; automated EC2 commitment optimization, but with a few differences:

|

Factor |

ProsperOps (Flexera) |

RightSpend |

|---|---|---|

|

Independence |

Acquired by enterprise giant |

Independent, AWS-focused |

|

Rebalancing frequency |

Periodic |

Hourly |

|

Lock-in |

Now part of broader platform |

Standalone, works with CloudFix or alone |

|

Pricing model |

Unknown post-acquisition |

25% of net new savings (you pay nothing if we don’t deliver) |

|

Focus |

Multi-cloud (AWS, Azure, GCP) |

AWS-native |

We call our approach “Commitment Free Discounts.” You get up to 55% EC2 savings without long-term lock-in. If your usage changes, we rebalance hourly. If you want to leave, you leave.

No forced bundling. No roadmap controlled by an enterprise parent. No wondering what happens next quarter.

What to Do This Week

If you’re evaluating your options, here’s a practical path:

- Document your current ProsperOps results. Effective Savings Rate, coverage percentage, monthly savings. You’ll need this baseline for any comparison.

- Ask your ProsperOps rep direct questions. Will pricing change? Will you need to migrate to Flexera systems? What’s the roadmap for the next 12 months? Get answers in writing.

- Evaluate at least one alternative. Whether it’s RightSpend or something else, know your options before you need them.

- Check your contract terms. When does your agreement renew? What are the exit terms? Acquisitions sometimes trigger termination clauses.

The Uncomfortable Truth About FinOps Tooling

Every FinOps tool vendor tells you they’ll save you money. Most of them (us!) do.

The question isn’t whether the tool works today. It’s whether the company will stay focused on making it work tomorrow.

Independent vendors like us have one job: keep you happy or you leave.

Acquired vendors have a different job: hit the parent company’s revenue targets, integrate with the platform strategy, and justify the acquisition price.

These aren’t the same job.

FAQ

Will ProsperOps keep working after the Flexera acquisition?

Yes, in the short term. Flexera says ProsperOps will “continue operating under its own brand.” But acquisitions typically lead to product changes within 12-24 months as integration priorities take over.

Is RightSpend a direct ProsperOps replacement?

For AWS EC2 discount optimization, yes. RightSpend automates Savings Plan and Reserved Instance management with hourly rebalancing. It doesn’t cover Azure or GCP because we’re AWS-focused by design.

What’s a Commitment Free Discount?

CFDs give you the same savings as 3-year Reserved Instances (up to 55%) without the commitment. Your usage changes, we rebalance. You want to leave, you leave. No lock-in, no prepayment.

How does RightSpend pricing work?

25% of net new savings. If we don’t find savings, you pay nothing. Our incentives are aligned with yours.

Can I use RightSpend alongside CloudFix?

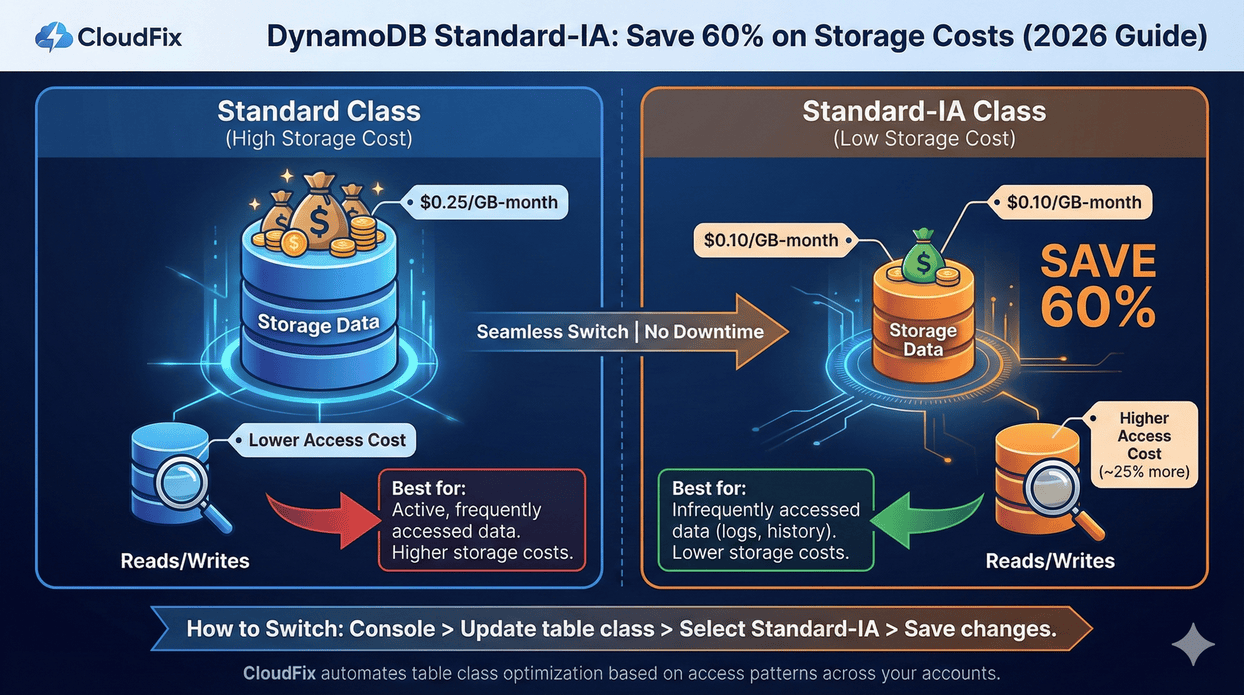

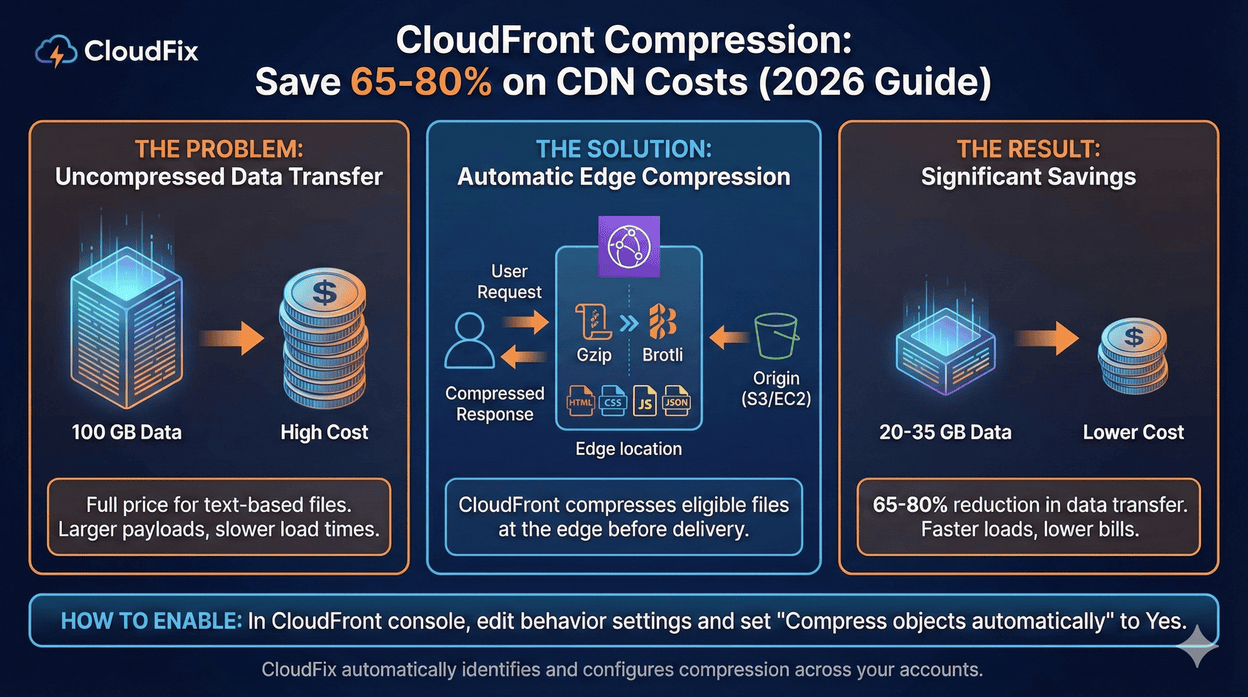

Yes. CloudFix handles resource-level optimization (GP2 to GP3, S3 tiering, etc.). RightSpend handles discount optimization. Together they cover both sides of AWS cost reduction. But RightSpend also works standalone.

How fast can I switch from ProsperOps to RightSpend?

Setup takes about 15 minutes. You’ll see savings opportunities within 24 hours. We work alongside existing Savings Plans and RIs, so there’s no hard cutover required. Having said that, it’s probably worth a call first – get in touch with us.

Check what you could be saving now!

No obligation, no tricks. All potential savings shown up front in detail.